Goods and Service Tax: The Framework, Council, and Complete Working

The imposition of GST (Goods and Services Tax) has been one of the most significant decisions taken by any government since independence. It’s compared with the independence movement of India itself by few in the government. The magnitude of impact GST has had on how the country functions as one single market created considerable speculation at first. Later on, as there were several changes made to the initial Act to better suit the different aspects of businesses and taxes, it was successful in streamlining its function. The immediate steps businesses and individuals had to take were to get their GST registration status verified, make themselves GST compliant, and file taxes according to the new law. There was a sense of eagerness about the latest GST notification from the GST council as there were rapid changes that happened to the GST law soon after its implementation and New tax slabs were introduced. The use of digital technology played a more prominent role as the GST council decided to create a GST portal for all tax needs of taxpayers. The GST portal acts as the medium between the Tax department and taxpayers. It’s part of the GSTN ( Goods and Services Network) that is responsible for handling everything related to the GST.

Table of Contents

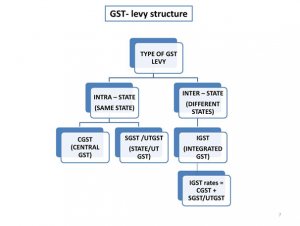

Structure of GST

There are three taxes under GST. The Central Goods and Services Tax (CGST), The State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST). The latest GST notification announced Goods and services tax is segregated into 5 tier tax slabs. 0.25%, 5%, 12% 18% and 28%. Until recently, there were only four tax slabs. To understand the structure of GST better, take a look at what SGST, CGST, and IGST signify.

SGST: State Goods and Services Tax. is governed under the SGST Act and is levied on the sales of Goods and Services within a particular state. State governments are responsible for the implementation of SGST. The revenue collected through SGST is remitted to the State governments. The tax subsumes all the previous taxes like Value Added Tax (VAT), State Sales Tax, Entertainment Tax, Entry Tax, surcharges, and cesses.

CGST: Central Goods and Services Tax has subsumed all the previous central taxes like Customs Duty, Central Excise Duty, Central Sales Tax, Special Additional Duty Tax, Service Tax Etc. The central government levies the CGST taxes, and the collection is remitted to the Central Government, which is collected under CGST. It is levied on the Intra-State supply of Goods and Services. CGST is levied on taxpayers, along with SGST.

Example of SGST and CGST tax structure:

If a supplier from a particular state sold goods worth Rs.1,00,000 to a retailer within the same state. The total GST rate will be 18%, with 9% towards SGST and 9% towards CGST. In such a scenario, the supplier collects Rs. 18,000, and payment of taxes will be Rs. Nine thousand to the Central Government and Rs. Nine thousand will be to the State Government.

IGST: Integrated Goods and Services Tax is a tax levied by the Central Government on inter-state dealings. It is also applied to the supply of Services and Goods imported or exported from India. When the supply of a Service or a product falls under different states, the tax collected is shared between the respective state government and the central government.

Example of IGST tax structure:

If a supplier of one state supplies services or goods worth Rs. 1,00,000 to a retailer or consumer in another state, the GST levied will be 18%. This 18% is entirely IGST. The supplier will charge the consumer or retailer of the other state 18% of the total product value that is Rs. 18,000. This will be paid towards the Central Government.

GST tax slabs

In the recent GST council meeting, it was decided that there would be a 0% tax on essential goods. Goods such as vegetables, meat, live animals, eggs, honey, etc. are exempted from GST. 0.25% tax is levied on semi-precious stones.

5% tax slab: Goods such as Coir mats, floor covering, insulin, Walking sticks, hearing aids, revenue stamps, Biogas, etc. are taxed under 5% tier.

12% tax slab: Handicrafts, Slide fastener, Fuel Cell Vehicle, Bamboo flooring, Brass kerosene pressure stove, etc. are taxed under 12% tax slab.

18% tax slab: Vacuum Cleaners, Food mixers, and grinders, hair cleaners, storage water heaters, hair and hand dryers, ice cream freezers, refrigerators, water coolers, etc. come under 18% tax rate.

28% tax slab: Luxury items such as luxury cars, tobacco, pan masala, etc. are taxed under 28%. Mostly luxury goods and services are taxed under this category.

There is a review in every year’s budget in GST council meetings about the products that are put under a certain tax slab. There are different goods that are taken out of a certain tax slab and brought under a different tax rate depending on what the council deems fit.

GST Council: GST council is responsible for making crucial decisions that directly impact GST. It is a 33 member body with the Union Finance Minister as chairperson. Other council members are union ministers of states of finance or revenue and ministers responsible for taxation and finance in their respective states. The GST council is empowered to make suggestions to the Union and state governments on the cess, surcharges, and taxes. It can revise any rule regarding GST or about the tax rates on Goods and Services.

How GST works

GST basically functions through GSTN, the Goods and Services Tax Network. It is a software developed by Infosys. GSTIN started as a Non-government entity, but recently the government has announced that it will undertake GSTIN. It is going to run solely by the government. It helps tax authorities access every transaction and taxpayer. It allows taxpayers the facility to file tax returns or pay taxes from anywhere using the GST portal. GSTIN uses high-end technology for different aspects of its functions. Computing power, handling complex tasks, and security. All are done in an efficient manner through GSTIN.

Conclusion

The change in the tax system affected every business and individual in various ways. The most significant advantages of GST is transparency and efficiency. There is transparency about a taxpayer to the authorities and even to business people. An individual can look up the GST registration status for assurance about the authenticity of a company or an individual. Though there are frequent changes that happen on various aspects of GST, the core rules and structure remain the same. With the latest GST notification through the GST council, it appears that they are focusing on cutting the losses and creating economic growth of the country.

Author: I’m Jaylin: SEO Expert of Leelija Web Solutions. I am a content manager, and the author of elivestory.com and a full time blogger. Favourite things include my camera, travelling, caring my fitness, food and my fashion. Email id: editor@leelija.com